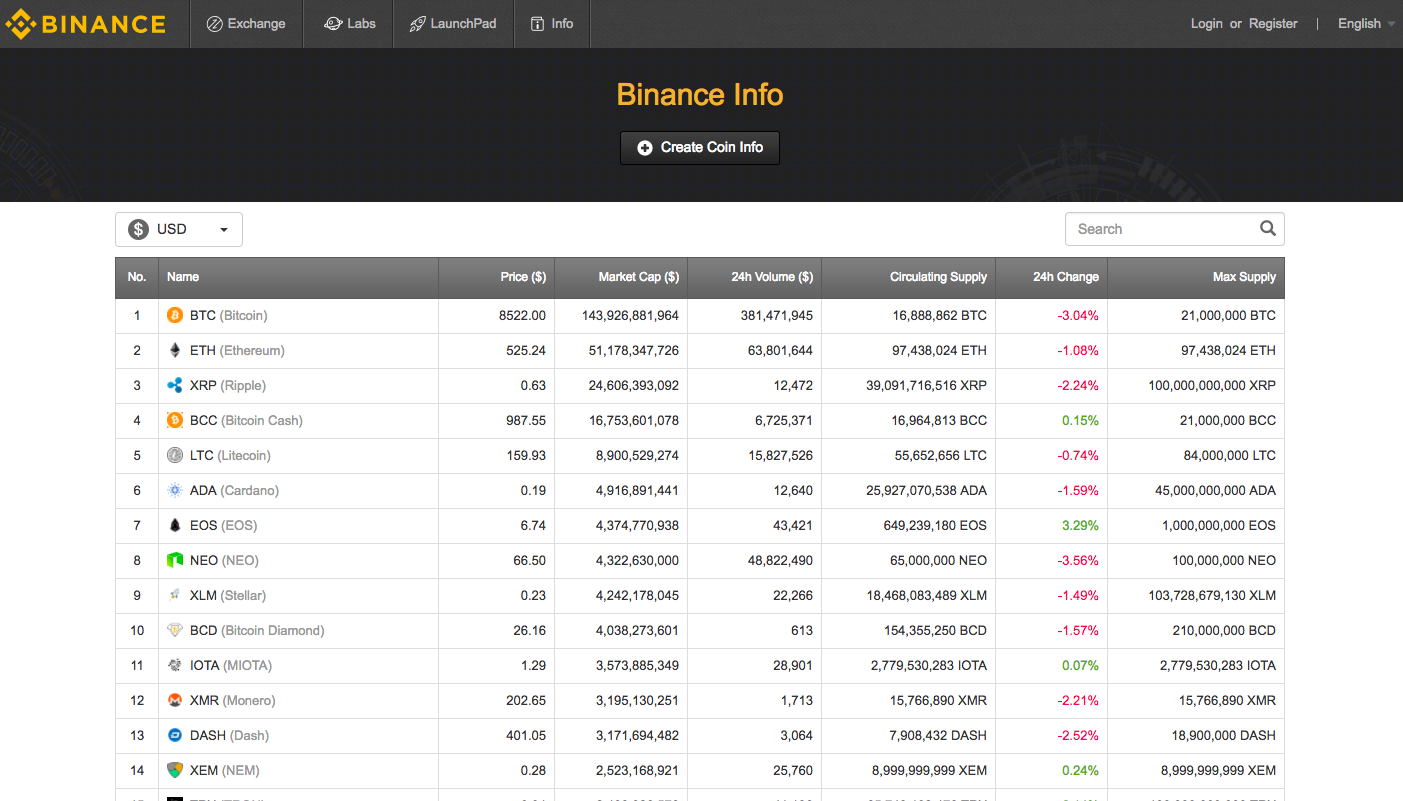

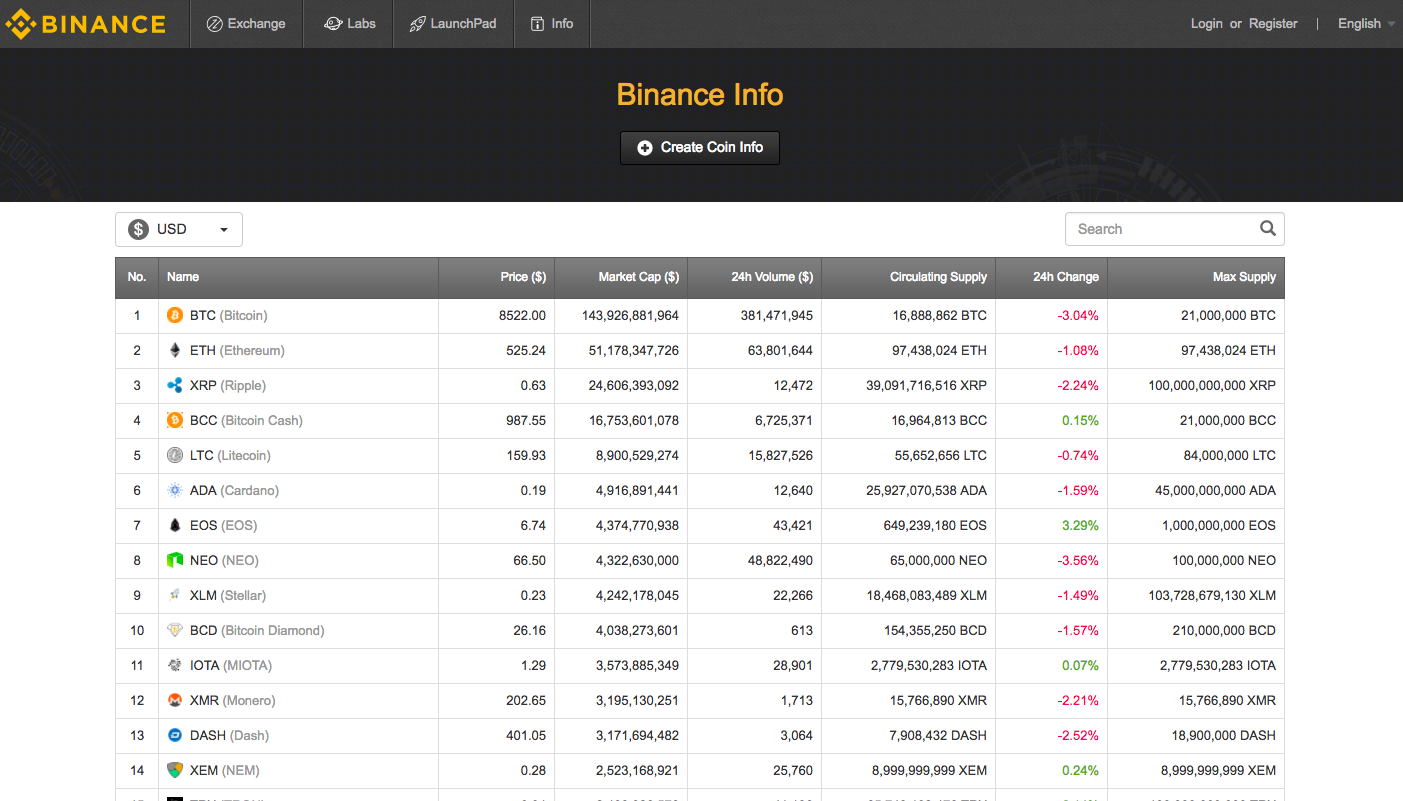

Currently, Binance has 3 different grid trading bots built-in the platform. Which other platforms are offering a GRID Bot?īinance added support for automated grid trading as one of the ways to keep people on its platform and earn more trading fees.

#Binance fees trading how to#

How to Set-up Your Grid Trading Strategy. Other platforms offering grid bots include 3Commas, KuCoin, and Bitsgap. Grid trading is a reliable strategy, easy to use, adaptable, offers enhanced risk management, allows for automated trading, works well in a sideways market, is versatile, and uses the grid strategy. There are options to check the active grid and history of your grid trading.īinance.US charges a flat 0.1% spot trading fee which is lower than many other US exchanges. There are several parameters to set up including symbol, isolated margin mode, balance profit, lower and higher amount, mode, grids, leverage/grids, primary margin, entire investment, quantity, activate type, and others. Grid trading mechanism is simple to use, from setting up the bot to using it on trading pairs. Once you have the desired options chosen, select “create”. There are various parameters to edit and select. Log into your account, go to the USD-M features trading interface, and click on Grid Trading. 🛠️ How to Set-up Your Grid Trading Strategy TWAP aims to achieve an average execution price close to the time-weighted average price of a user-specified period.

Spot and futures grid are similar, but the futures grid strategy allows for leverage up to 20x. Binance supports automated grid trading with three different grid trading bots: spot grid, futures grid, and TWAP.

0 kommentar(er)

0 kommentar(er)